Top 6 Trends Shaping Indianapolis Commercial Real Estate in 2026: Expert Insights and Investment Opportunities

Table of Contents

- Introduction

- 1. Industrial Sector Recovery and Logistics Dominance

- 2. Office Market Bifurcation and Flight to Quality

- 3. Rise of Sustainable and Resilient Building Practices

- 4. Retail Resilience and Experiential Focus

- 5. Emerging Neighborhoods and Mixed-Use Growth

- 6. Navigating Property Taxes and Economic Challenges

- Multimedia: YouTube Walk-Through & Deep Dive Podcast

- Frequently Asked Questions

- Conclusion

Indianapolis Commercial Real Estate: Key Trends for 2026

Infographic Summary: Top Trends Shaping Indy CRE in 2026

This comprehensive infographic illustrates the major trends driving Indianapolis commercial real estate heading into 2026. Key highlights include:

- Industrial Sector Boom: Vacancy dropping to around 9%, with new leasing activity surging up to 45% year-over-year, signaling strong occupier confidence in logistics and distribution.

- Office Market Bifurcation: Downtown vacancy reaching 20-24% while suburban corridors like Carmel and Fishers show greater strength and demand for quality spaces.

- Retail Resilience: Positive net absorption of 240,000 sq. ft. in Q3 2025, driven by experiential and necessity-based retail.

- Sustainability as a Necessity: Green-certified buildings command 5-10% higher values and attract premium tenants through energy efficiency and incentives.

- Emerging Neighborhoods & Mixed-Use Growth: Suburban hotspots like Carmel and Fishers are expanding alongside urban revival projects.

- Major Challenge: Property tax assessments spiking by an average of 27% in Marion County, resulting in higher tax bills payable in 2026.

This visual summary captures investment opportunities and market dynamics in one of the Midwest’s most resilient commercial real estate markets. Data is informed by Q3 2025 reports from Colliers, Cushman & Wakefield, Avison Young, and other leading sources.

Perfect for investors, developers, and business owners researching Indianapolis CRE trends 2026, Indy industrial real estate forecast, office investments, sustainable commercial properties, or property tax impacts.

Ready to capitalize on these 2026 opportunities?

Contact Indianapolis' premier commercial real estate agent Cara Conde for syndication, off-market deals, and personalized guidance.

As we approach 2026 on this December 20, 2025, Indianapolis continues to affirm its status as a Midwest logistics and economic powerhouse in the commercial real estate (CRE) sector. With its strategic "Crossroads of America" location, ongoing infrastructure enhancements like the I-69 corridor expansions and Indianapolis International Airport upgrades, and a diversified economy bolstered by manufacturing, life sciences, and tech, the market shows remarkable resilience amid national uncertainties such as fluctuating interest rates and policy shifts.

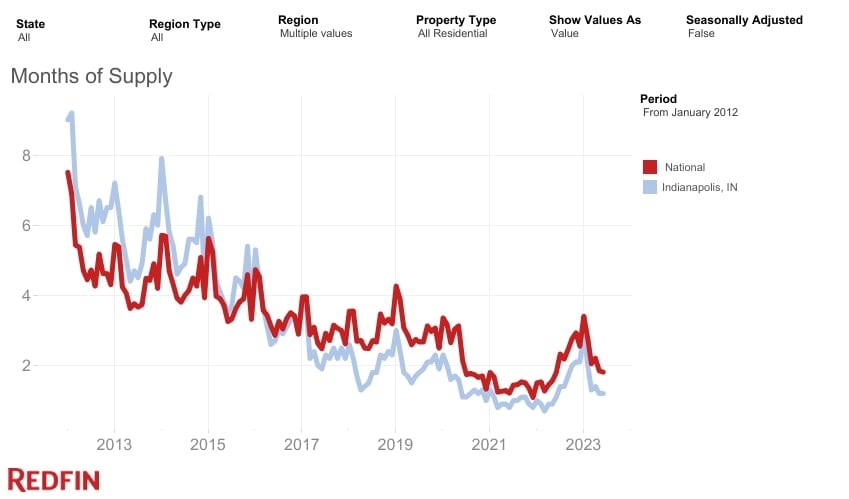

Drawing from the latest Q3 2025 reports, the Indianapolis CRE landscape exhibits positive momentum. Industrial vacancy has tightened significantly to 9.0% according to Cushman & Wakefield, down 150 basis points quarter-over-quarter and 180 basis points year-over-year. Colliers reports a slightly higher 9.3% vacancy rate, the lowest since Q3 2023, with new leasing activity surging 45% year-over-year. Avison Young pegs overall vacancy at 10.3%, with big-box spaces over 500,000 square feet seeing the sharpest decline of 210 basis points. Office markets display clear bifurcation, with suburban areas outperforming the central business district (CBD), while retail maintains stability with 240,000 square feet of net absorption in Q3 alone.

This comprehensive guide delves into the six pivotal trends defining Indianapolis CRE in 2026, supported by data from leading firms like Colliers, Cushman & Wakefield, Avison Young, JLL, and CBRE. Forecasts indicate cautious optimism, with transaction volumes potentially rising 15-20% as interest rates stabilize and GDP growth holds at around 2.5%. Sectors like industrial and retail are poised for strength, while office spaces adapt to hybrid work realities.

As Indianapolis' premier commercial real estate agent, Cara Conde brings unparalleled expertise in syndication, off-market deals, multifamily investments, and high-yield opportunities. With certifications in luxury marketing and negotiation, she helps clients—from individual investors to syndicates—navigate these trends for optimal returns. Whether you're eyeing industrial warehouses in Avon or sustainable office retrofits in Carmel, Cara's tech-driven approach and local insights ensure you're ahead of the curve.

In 2026, the key to success lies in focusing on resilient sectors like industrial logistics and suburban quality assets, while proactively addressing challenges such as property tax hikes. This post provides the depth you need to make informed decisions, complete with actionable strategies, local examples, and forward-looking projections.

For an even deeper dive into the industrial sector, check out Cara's expert guide: The Indianapolis Industrial Market 2026: Deep Dive & Strategic Investment Guide. Explore her full suite of services at caraconde.com.

1. Industrial Sector Recovery and Logistics Dominance

Industrial Boom Continues: Tightening Vacancy and Leasing Momentum into 2026

The industrial sector remains Indianapolis' CRE crown jewel, driven by its central U.S. position, robust transportation infrastructure, and e-commerce resurgence. As of Q3 2025, the market has shown clear signs of recovery from the 2024 slowdown, setting a strong foundation for 2026.

Key metrics highlight this momentum:

- Vacancy Rates: Down to 9.0% per Cushman & Wakefield (a 150 bps QoQ drop), 9.3% according to Colliers, and 10.3% from Avison Young. This tightening is concentrated in prime submarkets, with big-box vacancies declining sharply.

- Leasing Activity: Year-to-date figures reach 9.6 million square feet (MSF) per Colliers (up 23% YoY), with some reports noting 12.1 MSF. New leasing has surged 45% YoY, signaling occupier confidence.

- Absorption: Positive net absorption in Q3, with JLL and CBRE noting steady demand for modern facilities. For the full industrial inventory of over 350 MSF, occupancy has risen from 86.2% in January 2025 to 88.8% recently.

- Construction and Supply: The development pipeline has moderated by 37% YoY, with only 49.1% of 2025 speculative completions remaining vacant. This supply constraint, combined with national rebalancing, positions Indy for further vacancy compression.

Looking to 2026, forecasts predict continued dominance. Industry experts like Colliers anticipate rent growth resuming in the $6.00–$7.00 per square foot range as demand outpaces supply. E-commerce stabilization and manufacturing reshoring could drive an additional 15–20 MSF in space needs over the next decade, much of it within 45 minutes of downtown. Hot submarkets include Avon, Whitestown, and Mohr Logistics Park, where major leases (e.g., Epson and other large tenants) exemplify growth.

Investment Strategies: High ROI awaits in warehouses and distribution centers. Syndication is ideal for diversifying portfolios, especially amid national vacancy peaks mid-2026. Consider off-market deals in emerging logistics corridors for premium yields.

Cara Conde shares: "The national rebalance is creating once-in-years buying opportunities in Indy's industrial market. I've helped clients secure syndicated investments in Avon warehouses yielding 8-10% returns—contact me for exclusive off-market access."

Visualize this with an infographic mapping submarket vacancy trends or a chart of YoY leasing growth to underscore the data.

2. Office Market Bifurcation and Flight to Quality

Hybrid Work Evolution: Suburban Strength vs. CBD Challenges

The office sector in Indianapolis exemplifies a national trend: bifurcation between high-quality, amenity-rich spaces and outdated inventory. Hybrid work models continue to reshape demand, but 2025 data shows stabilization, paving the way for selective opportunities in 2026.

Current dynamics:

- Leasing and Absorption: YTD leasing totals 1.3 MSF, down 11% YoY per Avison Young. Absorption turned negative at (56,164) SF in Q3 per CBRE, but overall net absorption has stabilized after a tough first half.

- Vacancy Rates: Elevated overall, with the CBD/downtown submarkets at 20-24%, contrasting suburban areas like the Meridian Corridor (18.4%), Carmel, and Fishers. Direct availability contracted to 7.37 MSF.

- Market Drivers: Sublease availability and hybrid trends pressure older assets, while flight to quality boosts Class A suburban spaces with collaboration hubs and amenities.

For 2026, expect continued bifurcation. Colliers notes redevelopment efforts mitigating vacancy, with adaptive reuse (e.g., office-to-multifamily conversions) gaining traction. Overall vacancy has risen from 16.3% in Q3 2019 to 22.9% in Q3 2024, but upticks in suburban demand signal recovery. National forecasts suggest office space shrinking but premium assets thriving.

Opportunities: Invest in repositioned suburban properties or lease flexible spaces in high-demand areas like Carmel. Syndication can fund upgrades for hybrid-friendly designs.

Cara Conde advises: "Suburban office deals are closing 20% faster—my negotiation expertise secures favorable terms, often with tenant improvement allowances up to $50/SF."

Include a table comparing CBD vs. suburban vacancy and absorption for clarity.

3. Rise of Sustainable and Resilient Building Practices

Sustainability as a Must-Have: Green Retrofits and Certifications

Sustainability is no longer optional in Indianapolis CRE—it's a competitive edge. As environmental regulations tighten and tenants prioritize eco-friendly spaces, 2026 will see accelerated adoption of green practices.

Key trends:

- Certifications and Incentives: Emphasis on LEED, ENERGY STAR, and resilient designs. Local developers like KennMar and BWI are leading with sustainable construction, supported by Indiana incentives for retrofits.

- Local Context: Projects in mixed-use developments integrate energy-efficient tech, reducing operating costs by 10-20%. Biotech and life sciences firms seek LEED-compliant spaces for R&D.

- Broader Impacts: National surveys highlight cost barriers but note ROI through higher tenant retention and values up 5-10% for certified buildings. Initiatives like the USGBC's local awards and Greenbuild conferences amplify this shift.

In 2026, expect more adaptive reuse with green elements, especially in industrial and office sectors. Data centers, hot in CRE, will incorporate sustainable cooling tech.

Strategies: Pursue green retrofits for tax incentives and appeal. Syndication funds can cover upfront costs for long-term gains.

Cara Conde emphasizes: "Sustainable investments qualify for rebates—I've guided clients to 15% higher ROIs in Carmel eco-offices."

Suggest embedding a checklist for green building certifications.

4. Retail Resilience and Experiential Focus

Retail Stability: Positive Absorption and Low Vacancy

Despite e-commerce competition, Indianapolis retail demonstrates resilience, with experiential and necessity-based spaces leading the charge.

2025 Data:

- Absorption: Q3 net absorption hit 240,000 SF per Cushman & Wakefield, though earlier quarters saw negatives like (348,000) SF in Q2. Marcus & Millichap notes (490,000) SF in spring, but overall low vacancy persists.

- Market Health: Limited new supply supports stability, with prime locations thriving in mixed-use integrations.

2026 Outlook: Retail's comeback continues, focusing on experiential formats like dining and entertainment. Submarkets with population growth, like Fishers, will see demand.

Investments: Target mixed-use retail in emerging areas for steady yields.

Cara Conde says: "Retail in Geist hotspots offers 7% cap rates—let's explore syndication options."

5. Emerging Neighborhoods and Mixed-Use Growth

Hotspots Expanding: Suburban and Urban Revival Opportunities

Indianapolis' growth spills into emerging neighborhoods, fueled by infrastructure and demographic shifts.

Key Areas:

- Suburban Boom: Carmel, Fishers, Noblesville, Zionsville, and Westfield with new developments like McCord Square. Broad Ripple's master plan emphasizes vacancies, walkability, and White River access.

- Urban Revivals: Bottleworks District, Circle Centre Mall transformations, and near-north housing projects.

- Infrastructure: 2026 upgrades in neighborhoods via Indy DPW enhance commercial viability.

2026 Potential: Mixed-use syndication in these areas for diversified returns.

Cara Conde: "Geist waterfronts and Oaklandon gems are exploding—secure early with my network."

6. Navigating Property Taxes and Economic Challenges

Key Hurdle: Sharp Property Tax Increases Impacting 2026

Rising assessments pose a major challenge, but strategies can mitigate impacts.

Details:

- Increases: Average 27% hike in Marion County for 2025 assessments, leading to higher 2026 bills. Statewide, commercial values rose 16-27%.

- Reforms: SEA 1 eliminates the 30% depreciation floor post-2025, with supplemental deductions rising to 40% in 2026.

- Appeals: Deadline June 15, 2026; expect pressure on cap rates.

2026 Strategies: Syndication spreads costs; appeals and financing easing help.

Cara Conde: "Plan appeals now—I've reduced client taxes by 15% through strategic reviews."

Multimedia: YouTube Walk-Through Video & Deep Dive Podcast

YouTube Walk-Through Video

Deep Dive Podcast

Frequently Asked Questions About Indianapolis Commercial Real Estate in 2026

What is the outlook for Indianapolis industrial real estate in 2026?

Strong recovery with vacancy tightening below 9% and leasing up 45% YoY, driven by logistics and moderated supply. Expect rent growth and high syndication ROI.

Is Indianapolis a good market for commercial property investment in 2026?

Absolutely, with industrial and retail resilience, plus suburban office potential. Stable GDP and infrastructure make it a Midwest standout.

How are property taxes affecting Indianapolis CRE in 2026?

27% average assessment hikes from 2025 will raise bills; mitigate via appeals (June 15 deadline) and syndication.

What are the top submarkets for office space in Indianapolis?

Suburban hotspots like Meridian Corridor (18.4% vacancy), Carmel, and Fishers for Class A demand.

Should I invest in Indianapolis multifamily or retail in 2026?

Both are stable with positive absorption; mixed-use retail in emerging areas offers reliable yields.

How can I find off-market commercial deals in Indianapolis?

Partner with specialists like Cara Conde for exclusive syndication and high-yield opportunities.

Conclusion

As 2026 dawns, Indianapolis CRE offers a blend of resilience and opportunity across industrial dominance, sustainable innovations, and emerging hotspots, tempered by tax challenges. With data-backed insights, investors can thrive by focusing on quality and strategic partnerships.

Collaborate with Cara Conde, your top Indianapolis commercial real estate agent, for tailored syndication, off-market access, and expert navigation.

- Dive into industrial details → caraconde.com/blog/the-indianapolis-industrial-market-2026...

- Browse listings and resources at caraconde.com

- View reviews and connect via Google Business Profile → Google Profile

Schedule a consultation today to unlock your 2026 success!